Canada is a top choice for students from other countries, especially when considering the study cost in Canada. It offers great education at lower costs than many places. Living costs in Canada, including tuition, are reasonable.

For example:

Tuition fees in Canada depend on the province and program. Ontario has the highest tuition, but Newfoundland and Labrador are cheaper. Monthly living costs range from $1,225 to $3,136 CAD, depending on the city. Atlantic provinces are known for being affordable. These reasons make Canada a smart choice for students who want good education without spending too much, particularly when evaluating the study cost in Canada.

Undergraduate tuition in Canada differs by province, school, and program. International students pay more than local students. In 2024/25, the average international undergraduate tuition was over $40,000 CAD. This was a 5% rise from the previous year. Over the last decade, international tuition has grown faster than inflation by 6%.

| Tuition Type | Growth Rate Over Past Decade |

|---|---|

| Domestic | Inflation + 1.5% |

| International | Inflation + 6% |

Provinces like Ontario and British Columbia have higher tuition. Atlantic provinces, such as Newfoundland and Labrador, are more affordable. Tuition costs are now a big concern for students planning to study in Canada.

Graduate tuition for international students is lower than undergraduate fees. However, it still varies by program and school. On average, international graduate students pay $22,061 CAD yearly. This is nearly three times more than domestic students.

| Program | Domestic Fees (CAD) | International Fees (CAD) | Fee Difference (Factor) |

|---|---|---|---|

| Average (All Programs) | 7,573 | 22,061 | 2.9X |

| Architecture | 6,886 | 27,575 | 4X |

| Business Management | 14,293 | 27,239 | 1.9X |

| Engineering | 7,696 | 25,137 | 3.2X |

| Humanities | 4,678 | 14,217 | 3X |

Fields like architecture and engineering have higher fees than humanities. This lets students pick programs that fit their budget and career plans.

MBA programs in Canada are the priciest for international students. Fees range from $60,000 CAD to over $120,000 CAD, depending on the school.

| School | Average Fees (2024) in CAD |

|---|---|

| Rotman School of Management | $120,000 |

| Ivey Business School | $115,000 |

| McGill University (Desautels) | $90,000 |

| UBC Sauder School of Business | $80,000 |

| Queen’s Smith School of Business | $90,000 |

The cost of an MBA in Canada depends on the school and location. Schools like Rotman and Ivey charge more due to their rankings and alumni networks. On average, MBA tuition is around $80,000 CAD. This makes it a big investment for your future career.

When picking a program in Canada, tuition costs differ a lot. Some programs cost more because they need special tools or are in high demand. Here’s a simple breakdown of costs by field to help you decide.

Tip: Check tuition for your program and school. Some schools have lower fees for certain fields, helping you save money.

Knowing tuition costs by field helps you plan your studies and budget. Whether you pick health sciences or a cheaper field like humanities, Canada has options for every interest and budget.

Knowing the cost of living in Canada is important for students. It helps you plan your money and avoid overspending. This section explains key expenses like food, transport, and utilities.

Food is a big part of your monthly budget. You might spend $1,200 to $1,500 CAD each month on food. This includes eating out sometimes and buying groceries for cooking at home. Food prices depend on the city and store. Bigger cities like Toronto and Vancouver have higher costs than smaller towns.

To save money, shop at discount stores or buy in bulk. Cooking at home is cheaper than eating out. Farmers’ markets are also great for fresh and affordable produce.

| Category | Average Monthly Cost (CAD) |

|---|---|

| Groceries | $300 – $500 |

| Dining Out (Occasionally) | $100 – $200 |

| Total Food Expenses | $1,200 – $1,500 |

Tip: Make a meal plan and stick to a shopping list. This helps you avoid spending too much on food.

Transportation costs depend on where you live and how you travel. Public transit is the cheapest and most popular option for students. Monthly passes cost $100 to $150 CAD. Cities like Toronto, Montreal, and Vancouver have good transit systems, so you don’t need a car.

If you like biking, many cities have bike lanes. Walking is free and healthy for short trips. Owning a car is expensive because of gas, insurance, and repairs.

| Mode of Transport | Average Monthly Cost (CAD) |

|---|---|

| Public Transit Pass | $100 – $150 |

| Cycling (Maintenance) | $20 – $50 |

| Car Ownership | $500+ |

Note: Many cities give student discounts on transit passes. Ask your local transit office if you qualify.

Utilities and internet are must-have expenses in Canada. Utilities include electricity, water, and heating, costing about $204.25 CAD monthly. Costs range from $106.25 to $400 CAD, depending on your home size and the season. Internet with speeds of 60 Mbps or more costs around $84.62 CAD monthly. Mobile phone plans with 10GB of data cost about $62.65 CAD per month.

| Category | Average Cost (CAD) | Price Range (CAD) |

|---|---|---|

| Utilities (Electricity, Water, Heating) | 204.25 | 106.25 – 400.00 |

| Mobile Plan (10GB+ Data) | 62.65 | 35.00 – 104.00 |

| Internet (60 Mbps, Unlimited) | 84.62 | 60.00 – 125.00 |

To save money, turn off lights and use energy-efficient devices. Compare internet and mobile plans to find cheaper options.

Tip: Bundling your internet and phone plans can save you money each month.

Studying in Canada comes with extra costs that can add up fast. These depend on how you live and spend money. Knowing these costs helps you plan your budget better.

Personal care includes things like soap, shampoo, and haircuts. You might spend $100 to $150 CAD each month on these items. Buying in bulk or shopping at discount stores can save money.

Having a phone and internet is important for school and life. Monthly costs for these range from $50 to $100 CAD. Look for student discounts and compare plans to find the cheapest option. Bundling services can lower your bill.

Canada’s weather changes a lot, so you’ll need seasonal clothes. Winter items like coats, boots, and gloves are necessary. Clothing costs are usually $150 to $250 CAD per month. Shopping during sales or at thrift stores can help you save.

| Expense Category | Monthly Cost Range (CAD) |

|---|---|

| Personal Care | 100 – 150 |

| Phone and Internet | 50 – 100 |

| Clothing | 150 – 250 |

Tip: Write down what you spend on these items. Saving a little in each area can add up over time.

These extra costs are a key part of living in Canada. Planning for them helps you avoid surprises and stick to your budget.

Rankings give numbers, but reviews share real experiences. Students talk about professors, campus life, and even food! Websites like WhatUni or StudentCrowd are great for honest feedback.

Choosing where to live is an important part of studying in Canada. Housing costs depend on the type of place you pick. Below are the main options to consider.

On-campus housing, like dorms or residence halls, is a common choice. It’s close to classes and very convenient. Costs range from $4,000 to $16,500 CAD per school year. Shared rooms are cheaper, while private rooms cost more.

Living on campus often includes utilities, internet, and access to gyms or libraries. However, it can be pricier than living off-campus. Many students find private housing more affordable, so plan your budget carefully.

| Accommodation Type | Average Cost (CAD) |

|---|---|

| Dormitory | $4,000 – $16,500 per year |

Tip: Apply early for on-campus housing. Spots fill up fast at popular schools.

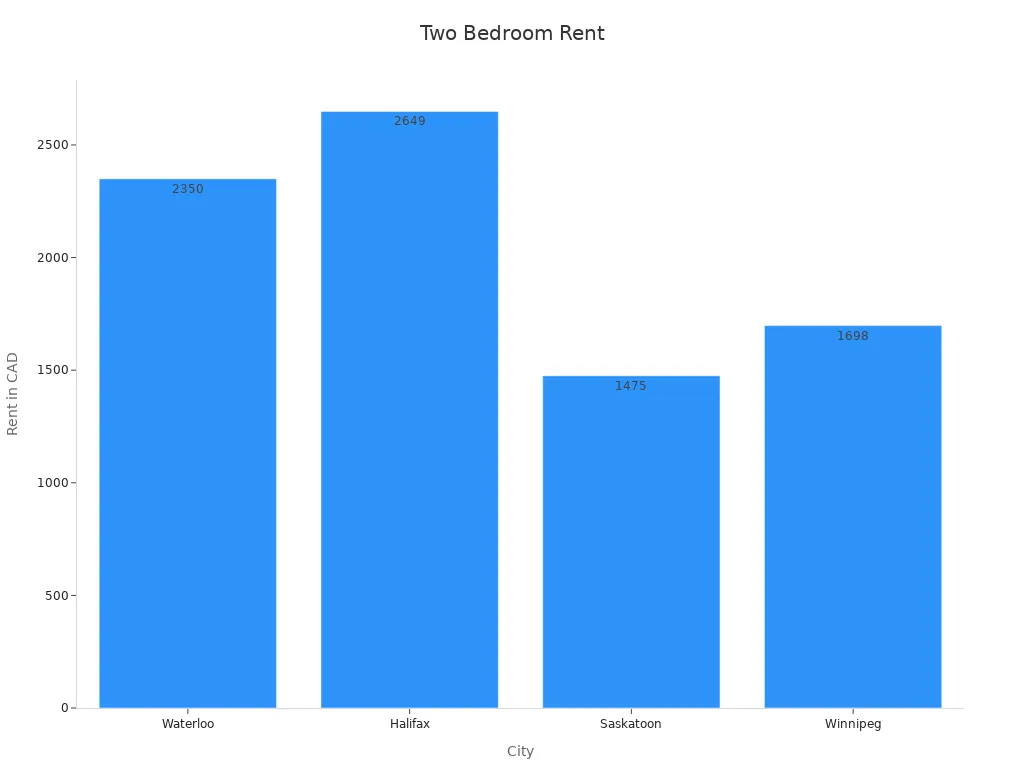

Renting off-campus gives you more freedom. Costs depend on the city. For example, a one-bedroom apartment in Toronto or Vancouver costs $1,200 to $2,000 CAD per month. In smaller cities like Saskatoon, rent can be as low as $600 CAD per month. Sharing a two-bedroom apartment with a roommate can save money.

| City | One-Bedroom Rent (CAD) | Two-Bedroom Rent (CAD) |

|---|---|---|

| Toronto/Vancouver | $1,200 – $2,000 | N/A |

| Montreal/Ottawa | $800 – $1,400 | N/A |

| Smaller cities | $600 – $1,000 | N/A |

| Waterloo | N/A | $2,350 |

| Halifax | N/A | $2,649 |

| Saskatoon | N/A | $1,475 |

| Winnipeg | N/A | $1,698 |

Off-campus rentals often don’t include utilities or internet. Make sure to budget for these extra costs.

Homestays let you live with a Canadian family. They cost between $800 and $1,500 CAD per month. This usually includes meals and a furnished room. Homestays are affordable and provide a welcoming environment, especially for newcomers

| Accommodation Type | Average Cost (CAD) |

|---|---|

| Homestays | $1,000 – $1,500 per month |

Note: Homestays are great for learning Canadian culture and improving English.

Your choice of housing depends on your budget and lifestyle. Whether you want the ease of on-campus housing, the independence of renting, or the cultural experience of a homestay, Canada has options for everyone.

Shared housing is a common choice for students in Canada. It lets you share rent and utility costs with others. This makes it one of the cheapest ways to live. It’s great for saving money and meeting new people.

In shared housing, you live with other students or tenants. Each person has their own bedroom. Spaces like the kitchen, living room, and bathroom are shared. This setup lowers costs and creates a friendly atmosphere.

| Expense Category | Estimated Monthly Cost (CAD) |

|---|---|

| Rent (per person) | $400 – $1,000 |

| Utilities (shared) | $50 – $100 |

| Internet (shared) | $20 – $40 |

Search online: Check websites like Kijiji, Craigslist, or Facebook Marketplace.

Join student groups: Look for university groups where rooms are posted.

Visit in person: Always check the place before signing a lease.

Tip: Agree on rules for cleaning, noise, and shared costs. This avoids problems and keeps things smooth.

Shared housing is a low-cost and social way to live in Canada. It helps you save money and enjoy a friendly living space.

To study in Canada, you need a study permit. The visa fee is $150 CAD and must be paid when you apply. This fee cannot be refunded, so plan for it early. If you want to work while studying, you might need a work permit. Work permits have extra fees.

Tip: Read the study permit rules carefully to avoid mistakes or extra charges.

International students must have health insurance in Canada. It costs $600 to $1,000 CAD per year, depending on your province and plan. Some provinces, like Alberta and British Columbia, offer free or cheaper health insurance for students with valid permits. In other provinces, you’ll need private insurance.

| Expense Type | Cost Range (CAD) |

|---|---|

| Health Insurance | 600 – 1,000 per year |

Note: Look into health insurance options in your province to find the best deal.

Textbooks and study materials can cost a lot. You might spend $600 to $1,500 CAD per year. Costs depend on your program and whether you buy new or used books. Some classes may need extra items like lab tools or software, which add to the cost.

| Expense Type | Cost Range (CAD) |

|---|---|

| Textbooks and Supplies | 500 – 1,500 per year |

Tip: Search online or ask student groups for second-hand books to cut costs.

Studying in Canada can bring surprise expenses. Planning ahead helps you avoid money problems and focus on school.

Health insurance doesn’t cover everything. Dental care or medicines often need extra payment. If you get sick or hurt, costs could be $50 to $500 CAD.

Tip: Save some money for medical emergencies. Check your insurance to know what it covers.

Canada’s winters are very cold. If you’re from a warm place, you’ll need winter clothes like jackets, boots, and gloves. These can cost $200 to $500 CAD, depending on where you shop.

Note: Shop during sales or at thrift stores to save on winter gear.

Sometimes, you may need to travel suddenly for personal reasons. A last-minute flight can cost $500 to $1,000 CAD. Local trips for events or internships might also add to your budget.

| Travel Type | Estimated Cost (CAD) |

|---|---|

| Last-minute flight | 500 – 1,000 |

| Local travel (monthly) | 50 – 150 |

Health insurance doesn’t cover everything. Dental care or medicines often need extra payment. If you get sick or hurt, costs could be $50 to $500 CAD.

Tip: Ask your program about extra fees before signing up.

Small costs like replacing keys, late fees, or buying supplies can add up. These might cost $50 to $200 CAD each semester.

Reminder: Keep track of your spending to avoid wasting money.

Planning for these surprise costs helps you manage your budget and stay stress-free while studying in Canada.

Scholarships and grants are great ways to pay for school in Canada. Many universities give awards for good grades, leadership, or activities outside of class. These scholarships lower tuition costs and make studying less stressful.

Here are some well-known scholarships:

| Scholarship Name | Average Award Amount | Duration |

|---|---|---|

| Dean’s Scholarship (University of Saskatchewan) | $18,000 per year | 2 years |

| Outstanding International Student Award (UBC) | $2,500 to $10,000 | Varies |

| President’s Scholarship for World Leaders (Winnipeg) | $5,000 | 1 year |

| President’s International Scholarship of Excellence (York) | $180,000 | 4 years |

| The President’s Scholarship (University of Ottawa) | $30,000 ($7,500/year) | 4 years |

| Chancellor’s Scholarship (Carleton University) | $30,000 ($7,500/year) | 4 years |

Big awards like the Vanier Canada Graduate Scholarships give $50,000 yearly for three years. The Pierre Elliott Trudeau Foundation Doctoral Scholarships offer up to $60,000 yearly for three years.

Tip: Apply early and read the rules for each scholarship. Some need high grades or leadership experience.

Part-time jobs let you earn money while studying in Canada. With a study permit, you can work up to 20 hours weekly during school. Common jobs include office assistant, teaching helper, translator, tutor, and freelancer.

| Job Role | Median Salary (CAD) | Description |

|---|---|---|

| Administrative Clerk | $22.50 | Office tasks, easy and steady work. |

| Teaching Assistant (TA) | $25.48 | On-campus job helping professors, saves travel time. |

| Translator | $30.77 | Uses language skills, good for students who know many languages. |

| Post-Secondary Tutor | $20.00 | Helps classmates in subjects you know well. |

| Freelancer | $23.51 | Flexible work based on skills, lets you plan your time. |

You can make $1,200 to $1,600 monthly during school. During breaks, you might earn $2,400 to $3,200 monthly. Yearly earnings range from $19,200 to $25,600, depending on how much you work.

Note: On-campus jobs save time and travel costs. They also fit well with your class schedule.

Canada has government programs to help international students. Most aid is for local students, but some provinces help international students too. For example, Alberta and British Columbia offer cheaper health insurance for students with study permits.

Federal programs like research grants or internships are also available. These can help you meet professionals and grow your career.

Tip: Visit provincial websites to find student aid programs. Some provinces have special help for international students.

Handling money as an international student in Canada can be tough. Making a budget helps you manage your spending and avoid stress. Follow these simple tips to keep your finances under control.

Tip: Check your budget often. Change it if your income or spending changes to keep it useful.

Budgeting helps you stay in control of your money and focus on school. With smart planning, you can enjoy studying in Canada without worrying about money.

Studying in Canada gives you good education without very high costs. Tuition fees differ a lot. International undergraduates pay about $38,081 CAD, which is over five times more than local students. Graduate programs cost less, with international students paying around $22,061 CAD yearly. Living costs depend on where you live and how you spend. Still, Canada is cheaper than places like the US or Australia. Don’t forget to budget for housing, food, and other needs.

You can lower your study costs by applying for scholarships, working part-time, or using financial aid. The exchange rate also helps international students save money. With smart planning, you can handle your expenses, focus on school, and enjoy studying in Canada.

Tuition fees depend on the program you choose. Undergraduate programs cost about $40,000 CAD yearly. Graduate programs are cheaper, costing around $22,061 CAD yearly. MBA programs are the most expensive, ranging from $60,000 to $120,000 CAD.

You can live on-campus, rent off-campus, join a homestay, or share housing. On-campus housing costs between $4,000 and $16,500 CAD yearly. Off-campus rental prices vary by city. Homestays cost $800 to $1,500 CAD monthly and often include meals.

Living costs include food, transport, utilities, and other expenses. Food costs range from $1,200 to $1,500 CAD monthly. Public transit passes cost $100 to $150 CAD monthly, depending on the city. Utilities and internet add another $250 to $300 CAD monthly.

You can apply for scholarships, grants, or work part-time. Scholarships like the Vanier Canada Graduate Scholarship give up to $50,000 CAD yearly. Part-time jobs let you earn $1,200 to $1,600 CAD monthly during school. Some provinces also offer financial aid.