The cost to study in the UK can range from £10,000 to £50,000 annually, depending on your chosen course and university. For example, prestigious institutions like Cambridge may charge up to £50,000. In addition to tuition fees, living expenses such as rent, food, and transportation typically amount to £1,425–£2,035 per month. You’ll also need to account for visa fees, which start at £348, and health insurance, costing £470 per year. Understanding the cost to study in UK ensures you can plan effectively and avoid financial challenges.

Studying in the UK in 2025 may cost £22,200 to £50,000 yearly. This includes school fees and living costs.

Tuition fees depend on the course and location. Undergraduate courses cost £9,250 to £30,000. Postgraduate courses cost £10,000 to £38,000.

Living costs, like rent, food, and travel, add £1,425 to £2,035 monthly.

Search for scholarships and funding to lower your expenses. Many schools and groups offer money to help students.

Plan your budget carefully. Use student discounts, get a part-time job, and pick cheaper housing to save money.

Planning to study for a bachelor’s degree in the UK? Tuition costs depend on the course and school you pick. Most programs cost between £9,250 and £30,000 yearly. Courses like medicine or engineering are usually more expensive. These fees may seem high, but they show the quality of UK education.

Since 2017-18, tuition fees in England have stayed the same. But inflation has made their value drop over time. Did you know UK tuition fees for locals are now 37% higher than in the U.S.? This shows how popular UK education is for students worldwide.

| Degree Type | Lowest Cost (GBP) | Highest Cost (GBP) |

|---|---|---|

| Undergraduate Studies | £9,250 | £30,000 |

| Other Degrees | £10,000 | £38,000 |

Master’s and PhD programs in the UK have many choices. Fees for these programs start at £10,000 and can reach £38,000 yearly. Special courses like MBAs cost more because they are intense and well-known globally.

If you’re from another country, you’ll see higher fees than local students. This is because international students get extra help and resources.

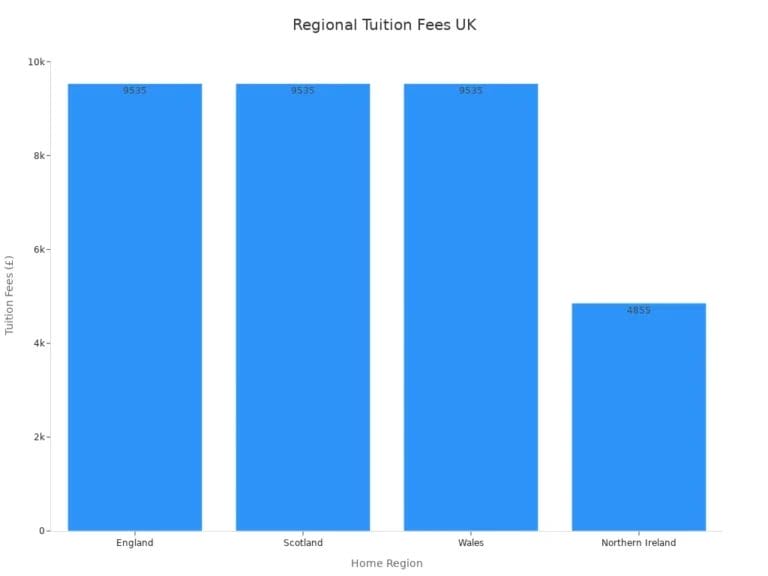

Where you study in the UK affects your tuition fees. England, Scotland, Wales, and Northern Ireland each have different fee rules. For example, Scottish students don’t pay tuition, and Northern Ireland has lower fees for locals.

Here’s the highest tuition fees in the UK for 2025:

| Home Region of Student | Max Tuition Fees (2025) |

|---|---|

| England | Up to £9,535 |

| Scotland | Up to £9,535 (Free for locals) |

| Wales | Up to £9,535 |

| Northern Ireland | Up to £4,855 (for locals) |

These fee differences can change how much you spend on school. To save money, think about studying in Scotland or Northern Ireland.

Picking a special program in the UK costs more. Courses like medicine, engineering, law, or MBAs are pricier. This is because they need advanced tools, skilled teachers, and tough training.

Medical degrees can cost £30,000 to £50,000 yearly. Engineering courses may cost £20,000 to £40,000 each year. MBAs are even higher, costing £25,000 to £60,000. These prices are above the average UK tuition fees for other courses.

Why are these programs so costly? They need high-tech labs, special tools, and expert training. Some include fieldwork, internships, or trips, which raise costs. International students often pay more for extra university support.

Tip: Look for scholarships or funding at your university. This can lower your costs.

If you want to join these programs, plan your budget well. Check fees for international students and other costs. Knowing this early helps you avoid surprises and make smart choices.

When planning your budget, living expenses in the UK are just as important as tuition fees. These costs can vary depending on your lifestyle, location, and choices. Let’s break down the key components of the total cost for studying in UK.

Accommodation is often the biggest part of students’ cost of living in the UK. On average, you’ll spend between £90 and £300 per week, depending on the type of housing you choose. University dorms are usually the most affordable, costing £90–£200 per week, with utilities included. Private rentals, on the other hand, range from £120–£300 per week, but you’ll need to budget extra for bills. Homestays, which include meals, cost £120–£200 weekly.

Where you live also affects your monthly cost of living. For example, renting in London averages £935 per month, while outside London, it’s around £583.

Here’s a quick look at average rental costs by region:

| Region | Average Monthly Rental Cost |

|---|---|

| London | £935 |

| Scotland | £606 |

| East Midlands | £512 |

| Northern Ireland | £484 |

| UK (excluding London) | £583 |

Food is another essential part of the cost of living in the UK. On average, you’ll spend £30–£40 per week on groceries. Staples like bread, milk, and rice are reasonably priced, with bread costing £0.71 and milk around £0.81 for 1.3 liters. If you prefer eating out, budget extra for occasional meals at restaurants.

Here’s a breakdown of typical grocery prices:

Cooking at home is a smart way to manage your cost of living in UK. It’s healthier and much cheaper than dining out.

Transportation ranks as the second-largest expense for international students in the UK. On average, you’ll spend £60–£65 per month on getting around. A student bus pass costs about £32 monthly, and a rail card offers discounts on train travel. These options can significantly reduce your monthly cost of living.

Note: Walking or cycling is a free and eco-friendly way to save on transportation costs.

Living expenses in UK can vary widely, but careful planning helps you manage them effectively. Whether it’s choosing affordable housing, cooking at home, or using student discounts, small changes can make a big difference in your budget.

When planning your budget, don’t ignore smaller daily costs. These include things like clothes, toiletries, and household items. They may seem small, but they are important for everyday life in the UK.

Here’s a simple list of common costs:

| Miscellaneous Items | Cost |

|---|---|

| Clothes | £30 – £50 |

| Household Items | £20 – £40 |

| Toiletries | £20 – £35 |

| Stationery | £15 – £30 |

| Insurance | £50 – £60 |

You should also save some money for fun activities or treats. These could include entertainment, subscriptions, or hobbies. Costs depend on your lifestyle, but planning ahead helps you avoid stress.

Tip: Use student discounts for clothes, stationery, and insurance. These can save you a lot of money over time.

Living costs in the UK vary by city. London is the most expensive, while cities like Manchester or Birmingham are cheaper.

Here’s a quick comparison of costs between London and Manchester:

If you want to save money, consider studying outside London. Other cities are cheaper but still offer great education options.

Note: London is more expensive but has unique cultural and career opportunities. Think about what matters most to you before deciding.

If you plan to study in the UK, don’t forget about visa and health insurance costs. These are important to stay legally and get healthcare while studying.

To study in the UK, you need a student visa. The Tier 4 (General) student visa costs £348. Short-term study visas are cheaper—£97 for six months or £186 for eleven months. From January 2025, you’ll need more money in your bank. Students in London must show £1,483 monthly. For other areas, it’s £1,136 per month.

Here’s a simple table of visa fees:

| Type of Visa | Application Fee |

|---|---|

| Short-term study visa (6 months) | £97 |

| Short-term study visa (11 months) | £186 |

| Tier 4 student visa (General) | £348 |

| Tier 4 student visa (Child) | £348 |

Tip: Apply early for your visa to avoid delays. Make sure you meet all money requirements.

The Immigration Health Surcharge (IHS) is another required cost. It lets you use the UK’s National Health Service (NHS). NHS gives free medical care and cheaper dental services. For most student visas, the Immigration Health Surcharge (IHS) for Indian students applying for a UK Student Visa is £776 per year.

Here’s a quick look at IHS fees:

| Visa Type | Fee per Year | Duration Condition |

|---|---|---|

| Student or Mobility Visa | £776 | More than 6 months |

| Other Visa | £1,035 | More than 6 months |

| Student or Mobility Visa | £388 | 6 months or less (inside UK) |

| Other Visa | £517.50 | 6 months or less (inside UK) |

Note: You pay the IHS when applying for your visa. It’s a one-time payment.

Besides visa and health insurance, there are other costs. These include course supplies, travel, and daily needs. These costs differ, but planning ahead helps.

Here’s a list of common extra costs:

Budgeting for these costs helps you avoid money problems while studying.

Studying in the UK costs a lot, but scholarships can help. Many universities, governments, and private groups offer funds. These can make your education more affordable. Let’s look at some options.

UK universities give many scholarships to attract bright students. Some are for good grades, while others reward talents like sports or music. Certain courses, like medicine or engineering, may have special scholarships too.

International students have many choices. Equal access scholarships lower fees for refugees. Disability scholarships help students with special needs. Check your university’s website to see what’s available and how to apply.

The UK government offers famous scholarships for global students. These help people who want to improve their communities. The Chevening Scholarship pays for master’s degrees fully. The Commonwealth Scholarship helps students from Commonwealth countries make a global impact.

These scholarships often cover tuition, living, and travel costs. They are very competitive, so make your application strong by showing your achievements.

Private groups and charities also give money to students. These are often flexible and focus on specific fields. For example, GREAT Scholarships support students from 18 countries. Some private scholarships are for areas like technology or environmental studies.

To find these, research groups related to your interests. Write a strong personal statement to improve your chances.

Here’s a quick list of popular scholarships:

| Scholarship Name | Description | Eligibility Criteria |

|---|---|---|

| GREAT Scholarships | For students from 18 countries in various subjects. | Open for 2025-26 applications. |

| Chevening Scholarships | Fully funded master’s degrees in the UK. | For international students. |

| Commonwealth Scholarships | For students aiming to make a global impact. | Open to Commonwealth countries. |

| Academic Scholarships | Based on strong school grades. | Requires excellent academic performance. |

| Performance-based | For talents in sports, music, or other activities. | Based on extracurricular skills. |

| Subject-specific | For certain courses like engineering or medicine. | Depends on the course of study. |

| Equal access scholarships | Lowers fees for refugees and asylum seekers. | For those fleeing danger. |

| Disability scholarships | Helps students with disabilities or special needs. | Based on individual requirements. |

Tip: Start looking for scholarships early. Many deadlines are months before classes begin.

Getting a scholarship to study in the UK can be tough. But with the right steps, you can improve your chances.

Here are some simple tips to help you:

Tip: The UK government has many scholarships for international students. These can help you pay for your studies.

Follow these tips to apply for scholarships with confidence. Being prepared and staying determined can help you achieve your dream of studying in the UK.

Making a budget is key to managing your money in the UK. Start by listing all your costs, like tuition, rent, food, and travel. Then, compare these costs with your savings, scholarships, or part-time job income. This helps you avoid spending too much.

Here are some simple ways to budget better:

| Strategy | How It Helps |

|---|---|

| Student Pass | Cuts down travel expenses. |

| Public Transport | Saves money by using buses or trains. |

| Local Bank Account | Avoids extra charges for international payments. |

| Scholarships and Grants | Reduces the overall cost of studying. |

| Student Discounts | Offers savings on daily needs and activities. |

By planning ahead and sticking to your budget, you can manage your money better.

Getting a part-time job can help cover your living costs. International students can work up to 20 hours weekly during school and full-time on holidays. This lets you earn money while still focusing on your studies.

Here’s what you can earn per hour in the UK:

| Age Group | Hourly Pay |

|---|---|

| 21 and over | £12.21 |

| 18-20 years old | £10.00 |

| 16-17 years old | £7.55 |

Jobs like working in shops, restaurants, or tutoring are common. These jobs not only pay but also teach useful skills and improve your resume. Check campus boards or local ads for job openings.

Tip: Don’t overwork yourself. Balance your job with your studies.

Housing is one of the biggest costs for students in the UK. To save money, think about living in university dorms. Dorms are cheaper and often include utilities. If you prefer renting, share a house with roommates to split the rent.

Here’s a look at average monthly rent:

| Region | Average Rent Per Month |

|---|---|

| London | £935 |

| UK (excluding London) | £583 |

Living outside London can save you a lot of money. Cities like Manchester or Birmingham are much cheaper than London. Compare your options and pick what fits your budget.

Note: Book your housing early to get the best prices.

Saving money on daily expenses can make a big difference in your monthly cost of living. You don’t have to sacrifice comfort or fun to stick to your budget. Small changes in your habits can help you manage the cost of living in the UK more effectively.

Start by cooking at home instead of eating out. Groceries in the UK are affordable, and preparing meals yourself saves money. For example, buying ingredients for a week’s worth of meals costs less than dining at restaurants. Plus, cooking lets you explore new recipes and eat healthier.

Another way to save is by shopping smart. Look for deals at local markets or discount stores. Many supermarkets offer loyalty cards that give you points or discounts. You can also buy in bulk for items like rice or pasta to reduce costs over time.

Transportation is another area where you can cut expenses. Walking or cycling is free and keeps you active. If you need public transport, get a student bus pass or rail card. These options lower your monthly cost of living significantly.

Finally, keep an eye on your energy usage. Turn off lights and unplug devices when not in use. Simple habits like these can reduce your utility bills and help you save more.

Tip: Track your spending with a budgeting app. It helps you see where your money goes and find areas to save.

Student discounts are your best friend when it comes to managing the cost of living in the UK. Many shops, restaurants, and services offer special deals for students. All you need is your student ID to unlock these savings.

Start with transportation. Most cities offer discounted bus and train passes for students. These passes can lower your monthly cost of living and make commuting more affordable. If you’re traveling internationally, look for student discounts on flights and accommodations.

Shopping is another area where you can save. Many clothing stores, bookstores, and tech shops offer discounts for students. For example, Apple and Microsoft often have deals on laptops and software for students. Always ask if a store has a student discount before making a purchase.

Entertainment is also cheaper with student discounts. Cinemas, theaters, and gyms often have reduced rates for students. You can enjoy movies, shows, or workouts without spending too much.

Note: Websites like UNiDAYS and Student Beans list hundreds of student discounts. Sign up for free to access deals on everything from food to electronics.

Using student discounts is an easy way to lower your cost of living in UK. Take advantage of these offers to make your budget go further.

Studying in the UK in 2025 may cost £22,200–£50,000 yearly. This includes tuition, living costs, and other expenses. Planning ahead can help you manage these costs better. Look into scholarships like Chevening or Commonwealth to save money. You can also work part-time and use student discounts to reduce spending. Budgeting for housing and travel is very important. Many students believe studying in the UK is worth it. A UK degree often leads to better jobs and higher pay.

Tip: Plan early to make studying in the UK more affordable for everyone.

It costs about £22,200–£50,000 each year. This includes tuition, living costs, visa fees, and health insurance. Your total cost depends on your school, course, and lifestyle.

Yes, students can work up to 20 hours weekly during school time. During holidays, you can work full-time. This helps pay for living costs and gives work experience.

Yes, many scholarships are available from schools, the government, and private groups. These can help pay for tuition, living costs, or both. Start looking early to find good options.

Housing costs depend on where and how you live. Dorms cost £90–£200 weekly, while private rentals cost £120–£300 weekly. London is pricier than other cities.

Yes, you must pay the Immigration Health Surcharge (IHS) with your visa. This lets you use the UK’s National Health Service (NHS) for medical care.